Business Insurance in and around Indianapolis

One of the top small business insurance companies in Indianapolis, and beyond.

Almost 100 years of helping small businesses

Help Protect Your Business With State Farm.

Though you work so hard to ensure otherwise, it is good to recognize that some things are simply out of your control. Mishaps happen, like a staff member gets hurt on your property.

One of the top small business insurance companies in Indianapolis, and beyond.

Almost 100 years of helping small businesses

Keep Your Business Secure

Protecting your business from these potential catastrophes is as easy as choosing State Farm. With this small business insurance, agent Eddy Hacker can not only help you devise a policy that will fit your needs, but can also help you submit a claim should an issue like this arise.

Do what's right for your business, your employees, and your customers by calling or emailing State Farm agent Eddy Hacker today to discover your business insurance options!

Simple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

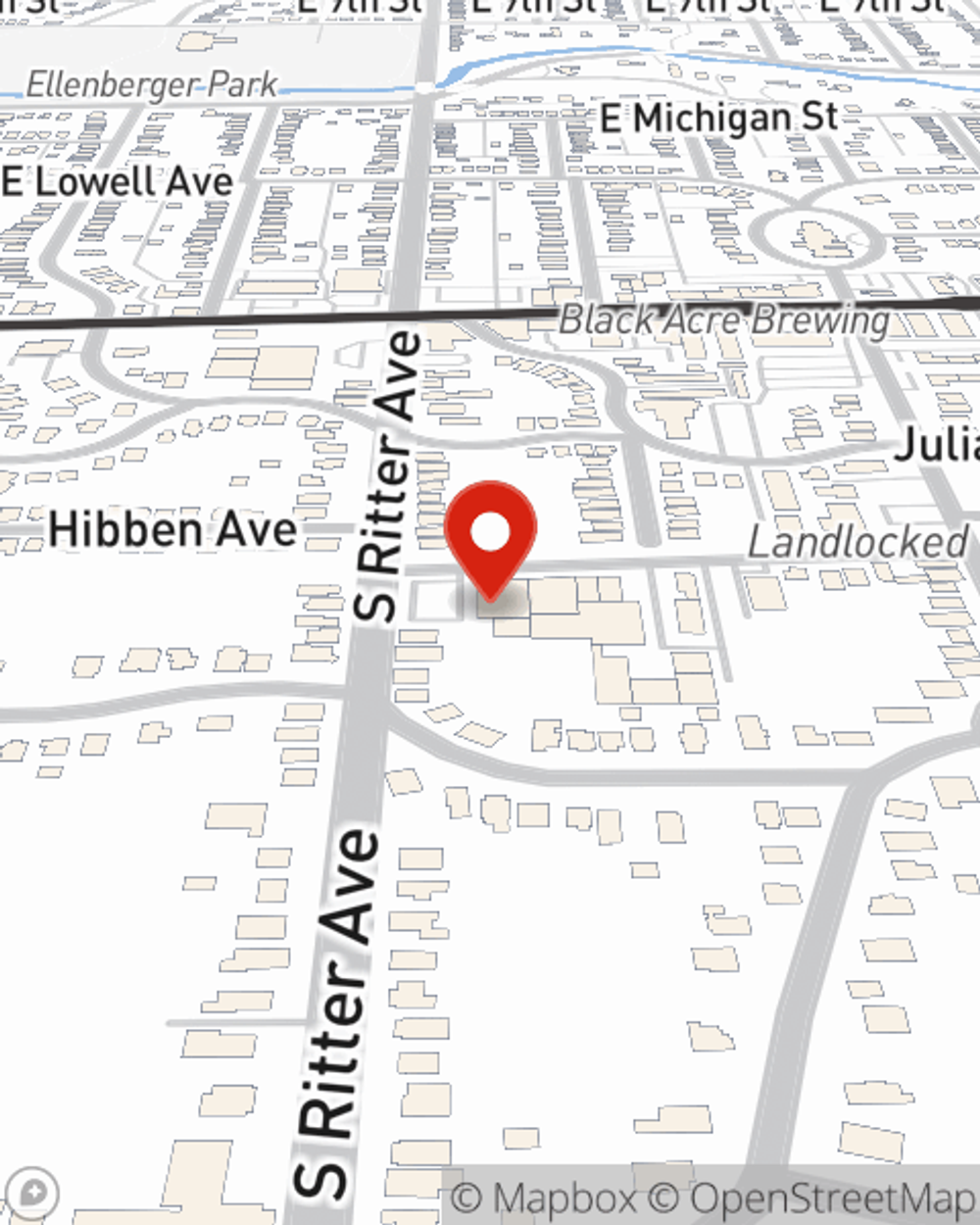

Eddy Hacker

State Farm® Insurance AgentSimple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.